Applications are due in June, with a final decision expected by December, according to the New York State Gaming Facility Location Board

Published Thu, Apr 24, 2025 · 10:50 AM

[LOS ANGELES] Las Vegas Sands is dropping efforts to develop a New York casino, partly over concerns that online betting in the state would crimp results for a land-based property.

The company announced the decision on a call with investors on Wednesday (Apr 23), saying it’s in the process of seeking an agreement with a third party that’s interested in bidding for a casino license on the proposed site.

One of the world’s biggest casino operators, Sands had proposed a project costing upward of US$5 billion at the site of the Nassau Veterans Memorial Coliseum on New York’s Long Island. Construction of such a project could take years. The company operates resorts in Macau and Singapore.

The state is considering three new casinos in the New York City area, and numerous parties have expressed interest, including Caesars Entertainment, Wynn Resorts and Mets owner Steve Cohen. Applications are due in June, with a final decision expected by December, according to the New York State Gaming Facility Location Board.

New York has become the top market for sports betting, most of which is done online. The state does not yet allow online wagers on casino games such as blackjack and slot machines. But results for land-based casinos have been hurt in states that do, such as Pennsylvania and New Jersey.

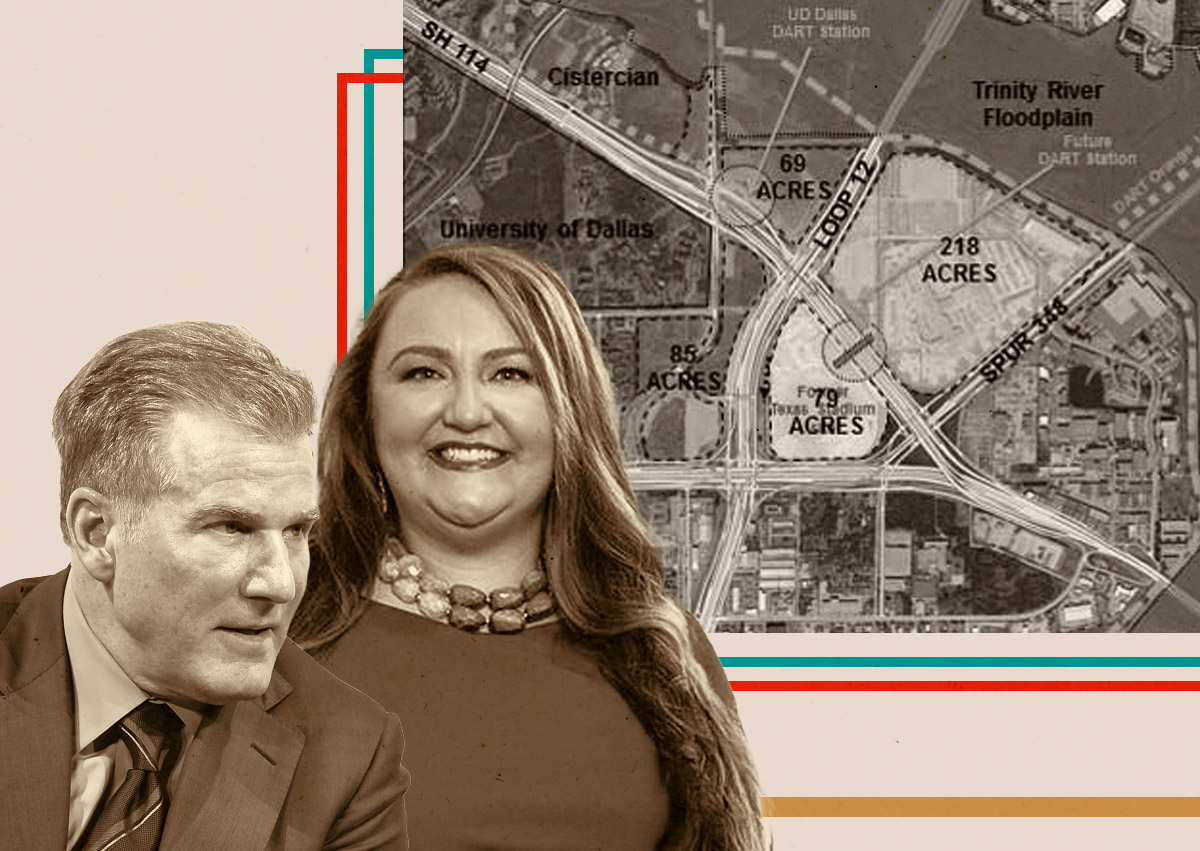

The Adelson family, which controls Sands, acquired a majority of the Dallas Mavericks basketball team and has been interested in a casino in Texas if that state were to legalise such betting.

Earlier Wednesday, the company announced it is increasing authorised share repurchases to US$2 billion from the US$1.1 billion remaining under a previous plan.

The company also reported first-quarter adjusted earnings of US$1.14 billion before interest, taxes, depreciation and amortisation, in line with Wall Street estimates. Adjusted earnings per share were 59 US cents, compared with Wall Street estimates of 57 US cents. Revenue fell 3.3 per cent to US$2.86 billion. BLOOMBERG

Share with us your feedback on BT’s products and services